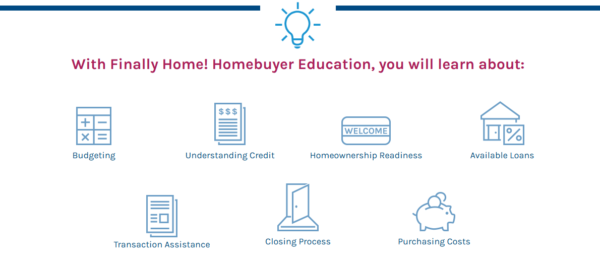

The Texas Department of Housing and Community Affairs has partnered with Finally Home! to provide comprehensive Homebuyer Education Counseling Services for individuals looking to purchase a home in Texas.

As TDHCA’s preferred option Finally Home is designed to help buyers navigate the homebuying process with confidence and informed decisions .

Homebuyer Ready, the Right Way

Home is Closer than you Think

While there are many choices for a required Homebuyer Education course, TDHCA recommends Finally Home. TDHCA will also accept a Completion Certificate from any other HUD Certified Homebuyer Education provide, including :

Freddie Mac CreditSmart® Homebuyer U : Freddie Mac CreditSmart